Retirement withdrawal calculator with inflation

- Create a monthly or annual payout schedule. - Enter an annual inflation rate to automatically increase the amount withdrawn each period.

Retirement Withdrawal Calculator

The Annuity Calculator was designed for use as a retirement calculator where withdrawals are made each year.

. The initial withdrawal will be adjusted for inflation based on the number of years until your retirement. Impact of Inflation on Retirement Savings. The answer is critical as retirement can last 25 years or more these days so you need a strategy thats built for the long haul.

If you run a 1 year retirement with a 10 withdrawal rate starting with 1M youd compound 1M by the average 1 year return from 1928 - today and that results in an average balance of 101M a low of 470k and a high of 143M. 720 of one years income can be withdrawn and the funds still will last until death. These are the required assumptions and every calculator must have these inputs.

Assumptions and Limitations of the Personal Retirement Calculator. Increase for your income This is the percentage of additional income you think you will need each year based on inflation an economic measure of increasing prices for goods and services. The withdrawal amount will be significantly higher if the assumptions are changed in the case for example of a higher inflation rate.

Use our free retirement withdrawal calculator to evaluate your plan. The withdrawal amount translates to a monthly withdrawal amount of or a quarterly withdrawal amount of. It is the simplest most straightforward of all possible models by emulating a fixed income bonds and cash portfolio with a progressive amortization of principal until all the assets are spent.

The formers contributions go in pre-tax usually taken from gross pay very similar to 401ks but are taxed upon withdrawal. We arrived at as your desired pre-tax retirement income because you indicated you wanted a post-tax income of 50000 adjusted at a 2 rate of inflation for when you retire at years old. This retirement calculator is for retirement planning.

Savings retirement investing mortgage tax credit affordability. If I take. According to the US.

A sustainable withdrawal rate. This calculator uses the new RRIF factors brought in by the Federal 2015 Budget. It has a savinginvesting cash flow and a withdrawal cash flow.

Free fast and easy to use online. This easy-to-use calculator makes retirement planning a breeze. A withdrawal savings calculator that optionally solves for withdrawal amount starting amount interest rate or term.

The new factors apply to all RRIFs LIFs and LRIFs no matter when the plan was set up. The above table will likely show you need to work slightly longer because your withdrawal rate should be less than your return on investments. Department of Labor the average inflation rate was 18.

The early withdrawal penalty if any is based on whether or not you would be taking the withdrawal from your retirement plan prior to age 59 ½. Annual return on investment is after taxes and inflation. I understand this is not what you want but mathematically it is correct.

Based on your effective tax assumption of 15 your annual after-tax income is. You wanna calculate something. The sustainable withdrawal rate is the estimated percentage of savings youre able to withdraw each year throughout retirement without running out of money.

ÿÿ3 4 I3Pdïª31Æ ýñëÏÿ Œ LÕfw8n çVÍüçršçŽ-8 Õlk èÏLûrz O 4 ÅLöi²9³n B b Ð EU¹. At the time of retirement this will provide a pre-tax income of which may increase at the rate of inflation throughout retirement. Our Retirement Calculator can help by considering inflation in several calculations.

The investment calculator adjusts the withdrawal for inflation once a year not each month. All retirement calculators require the same basic inputs to work their magic your retirement age life expectancy inflation investment return portfolio size and expected retirement expenses. Watchdog Workers who move 401ks into IRAs can lose significant money to a choice they didnt have to make new analysis shows.

Dont get the inflation adjustment of the withdrawal amount mixed up. You think you can earn 5 per year in retirement and assume inflation will average 35 per year. It also provides you with a recommendation for additional savings if your projected funds fall short.

How much can I afford to. Because retirement investing can be so difficult MarketBeat has a new easy-to-use tool that can help you see what. The calculator shows this large withdrawal as you pointed out in the first year.

Retirement calculator answers all retirement questions including how much do I need to retire. The table is based on projections using future 10-year projected portfolio returns and volatility updated annually by Charles Schwab Investment Advisor Inc. Minimum withdrawal will be used if it exceeds desired withdrawal once RRSP is converted to a RRIF.

A very basic fixed-annuity calculator assumes the withdrawals are constant for n years. If you withdraw money from your retirement account before age 59 12 you will need to pay a 10 early withdrawal penalty in addition to income tax. Retirement Withdrawal Calculator - If youre already retired or close to retirement calculate how much you can withdraw from your savings to last through retirement.

Our Retirement Savings Calculator is designed to help you evaluate whether or not your current retirement savings are sufficient to generate the inflation-adjusted retirement income you need to last the full duration of your retirement. This is an important part of any retirement planning calculation. Inflation factor will not affect minimum withdrawal.

This amount doesnt include your pension or social security if theyve already started. This withdrawal amount is inflation-adjusted assuming a default rate of 217 or your selected percentage. Saving for retirement is the biggest objective of investors.

Retirement Budget Calculator can help you estimate your budget life expectancy net worth taxes withdrawal strategies Roth conversions and ultimately answer the question. Willy - an all stock portfolio is 100 SP 500. You decide to increase your annual.

A common retirement strategy can erode your savings. This calculator makes assumptions. Show assumptions Avg Household Savings Rates 2008 Sources.

For example if you are planning on needing retirement withdrawals for 20 years we suggest a moderately conservative asset allocation and a withdrawal rate between 49 and 54. Claiming benefits before your full retirement age FRA reduces your checks. In the last 40 years the emergence of the individual retirement account IRA 401k Roth IRA SEP IRA and other investing tools have made saving for retirement accessible for a large part of our population.

Are you getting ready to retire or within 5 years of retirement. For these reasons this retirement withdrawal calculator models a simple amortization of retirement assets. There are no international stocks used in this calculator.

You are more likely to make monthly. However the reality is that the withdrawal amount will most likely need to increase each year due to inflation. In contrast Roth IRA contributions are deposited using after-tax dollars and are.

If you begin claiming at 62 youll get only 70 of your standard benefit if your FRA is 67 or 75 if your FRA is 66.

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Retirement Age Calculator With Printable Schedule Chart

World Retirement Calculator By Emily Glick

Will You Have Enough To Retire The 4 Rule May Help Within Limits

Canadian Retirement Calculator By Emily Glick

Fire Calculator When Can I Retire Early Engaging Data

Retirement Withdrawal Calculator How Long Will Your Savings Last 2020

Retirement Calculator

Saving For Retirement Calculator Wealth Meta

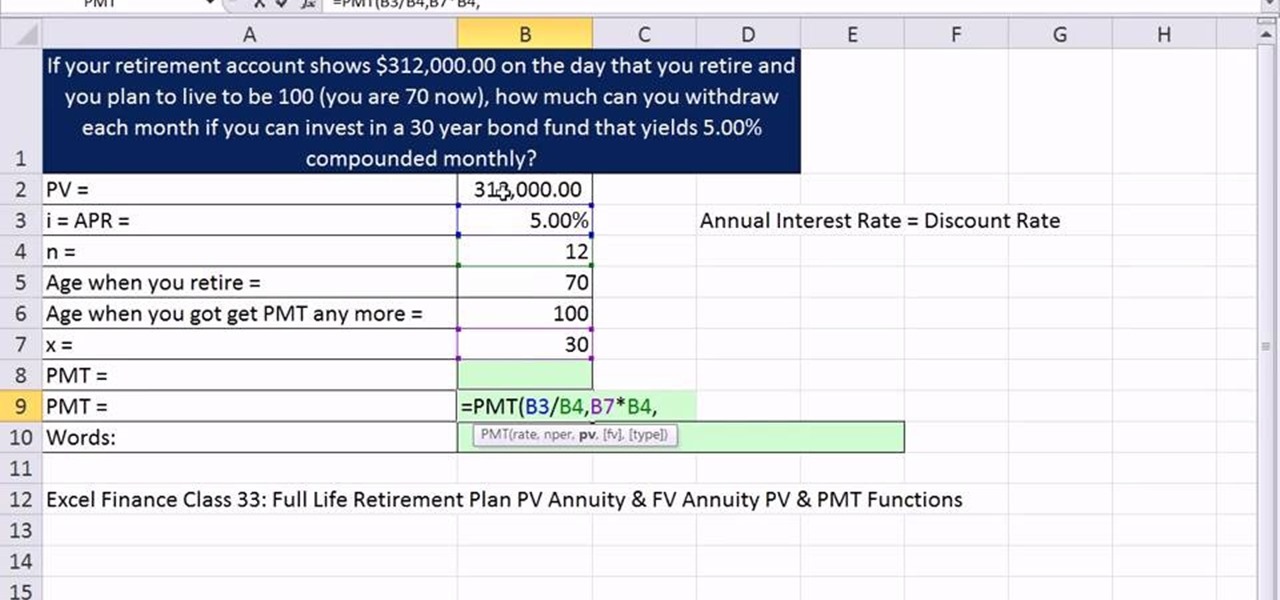

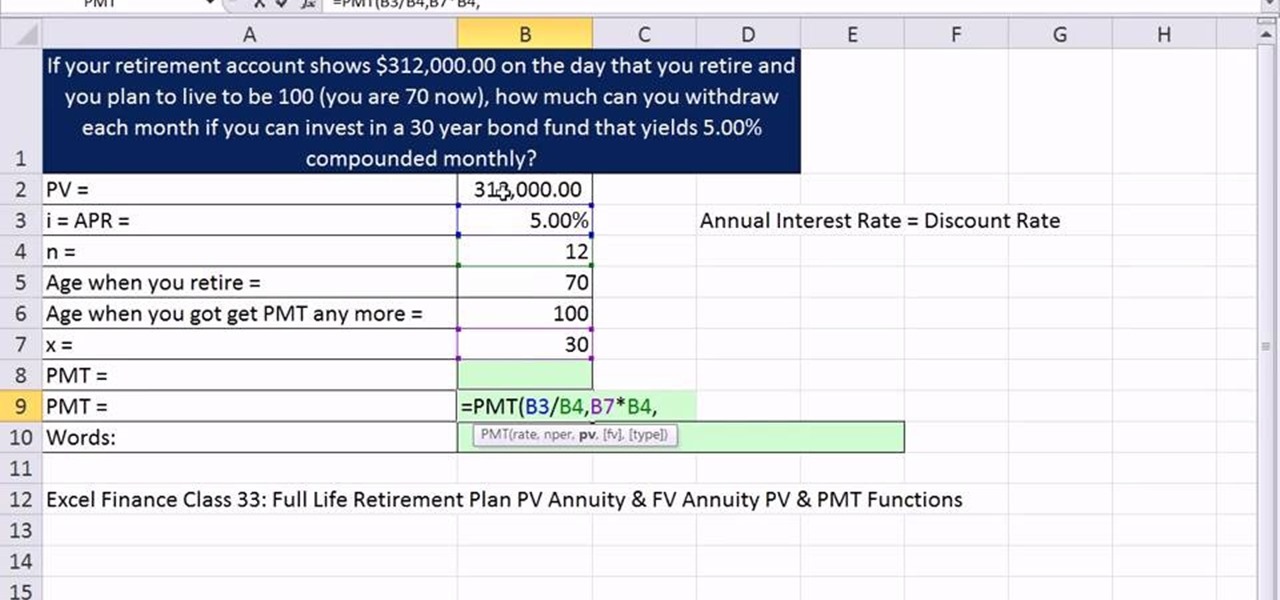

How To Calculate Monthly Retirement Income In Microsoft Excel Microsoft Office Wonderhowto

Workbook Fire Wealth And Retirement Calculator

Retirement Budget Calculator Do I Have Enough To Retire

Retirement Withdrawal Calculator For Excel

Retirement Withdrawal Rate Calculator Financial Calculators Retirement Calculator Retirement Portfolio

The 10 Best Retirement Calculators Newretirement

Traditional Vs Roth Ira Calculator

Free Retirement Planning Calculators Money Tip Central